Term Used to Describe the Difference Between Revenue and Expenses

Expenses are done by an organization so that it can run on a day to day basis. An expense is the cost of an asset used by a company in its operations to produce revenues.

Deferred Revenue Expenditure Definition Examples

You can also consider an expense as money you spend to generate revenue.

. For example the expense of rent is needed to have a location to sell from to produce revenue. Deductions expenses deduction or expense. The retirement of bonds payable at a cost that is greater than the carrying value of the bonds.

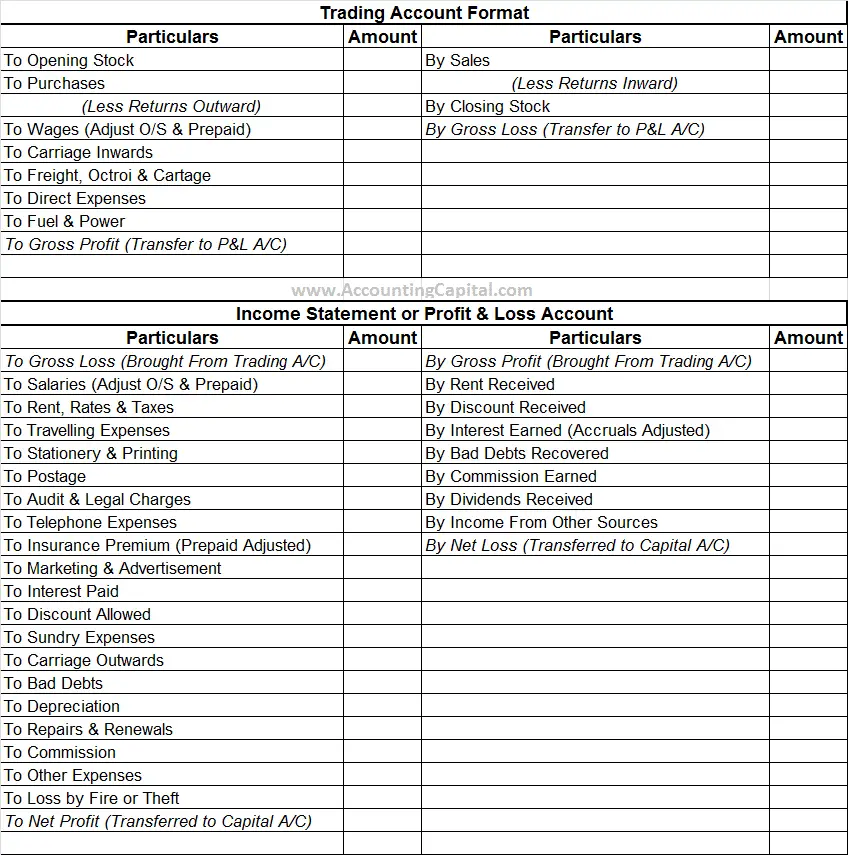

Expenses The costs incurred to produce revenues. Revenue is the amount of sales that a business makes during a period and expenses relates to the expenditure incurred in realizing the sales in that period. Most but not all expenses are deductible from a companys income revenues to arrive at its taxable income.

In general the terms favorable and unfavorable are used to describe the effect of a variance on. Expenditure is incurred once in a period. Deductions expenses deduction or expense.

The FASBs Statement of Financial Accounting. The depreciation expense for the mower was 300. The difference between the two column totals would be 1200.

The terms Master Budget and Flexible Budget mean the same thing and can be used interchangeably. Revenues Amounts received from customers for products sold or services provided. What is the term that is used to describe the difference between the total debit and credit amounts in a T-account.

What is the term used to describe the difference between revenue and expenses. Businesses can write off tax-deductible expenses on their. In other words an expense is the use of assets to create sales.

Expenditure is usually the long-term costs of the organization. Expenditures and expenses are terms used in the accounting department to refer to the costs incurred by the organization. Excess of Revenues over Expenses.

An expense is the cost of operations that a company incurs to generate revenue. A number of times suffered. View the full answer Previous question Next question.

Alex purchased a personal lawn mower to use for mowing his lawn and the lawns at his rental properties. During a companys first year of operations the asset account Office Supplies was debited for 2300 for the purchases of supplies. Revenue is the amount of money a businessperson makes as a whole.

Items that are not tax-deductible vary by region and country. You need to spend money on advertising to get customers and on a phone number to get them to call you. An expense is an ongoing payment like utilities rent payroll and marketing.

Loss is also used to describe write-down of inventory from cost to market. They are both recorded in the same financial year as they are incurred and cannot be forwarded to the next financial year. An expense incurs multiple times.

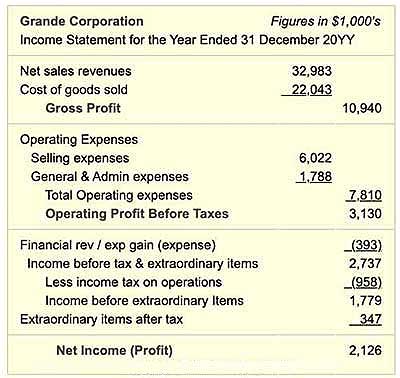

Notice that I didnt say its the amount of money spent to generate sales. That income is also referred to as profit loss earnings or the bottom line. Net income The difference between revenues and expenses.

An expense is basically a cost incurred by a business or money spent to earn revenue from the sale of its goods or services. To close the service revenue interest expense and operating expenses accounts will increase retained. Revenue is the total amount of income generated by the sale of goods or services related to the companys primary operations.

Revenue is the term used to describe income earned through the provision of a business primary goods or services while expense is the term for a cost incurred in the process of producing or offering a primary business operation. Income revenues or revenue. Expenses refer to the costs incurred by enterprises so that they can gain revenue.

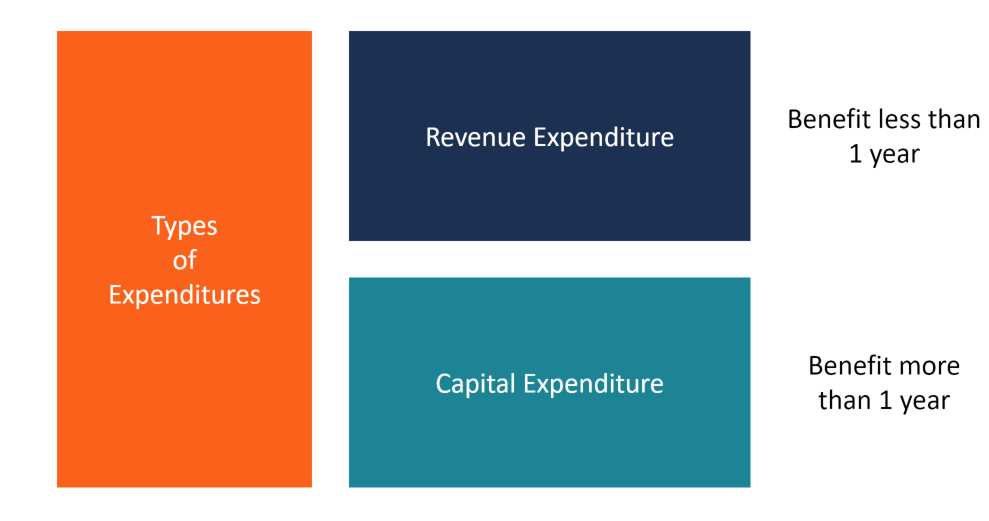

Finally loss is also used to describe the bottom line of an income statement that reports expenses in excess of revenues. Statement of Stockholders equity. CapEx is related to long-term spending a major investment while a revenue expenditure is related to short-term operating expenses.

Hence the excess of revenue over expenses refers to the ne. Account balance For any given account the difference between the total debit and credit amounts is the account balance. Rather revenue is the term used to describe income earned through the provision of a business primary goods or services while expense is the term for a cost incurred in the process of producing.

Expenditures are costs incurred when purchasing assets for the company or paying for a significant proportion of company liabilities. Profit which is typically called net profit or the bottom line is. Expenses are created when an asset is used up not when cash is paid out.

Expenses lower owners equity but they are used to earn revenue. At year-end a physical count of the supplies on hand revealed that 825 of unused supplies were available for future use. The most common tax-deductible expenses include depreciation and amortization rent salaries benefits and wages marketing advertising and promotion.

An expense is done for general expenses.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

How Do Capital And Revenue Expenditures Differ

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

Income Statement Definition Uses Examples

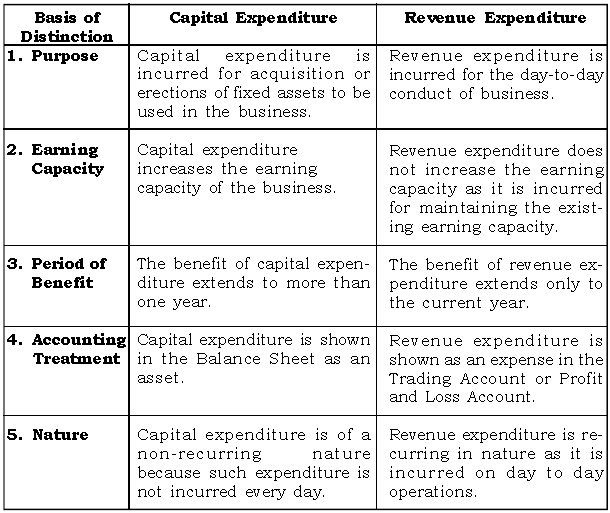

Dk Goel Solutions Class 11 Chapter 20 Capital And Revenue

Financial Accounting Capital And Revenue

Tutor2u Key Issues In Making Investment Decisions

/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

How Do Capital And Revenue Expenditures Differ

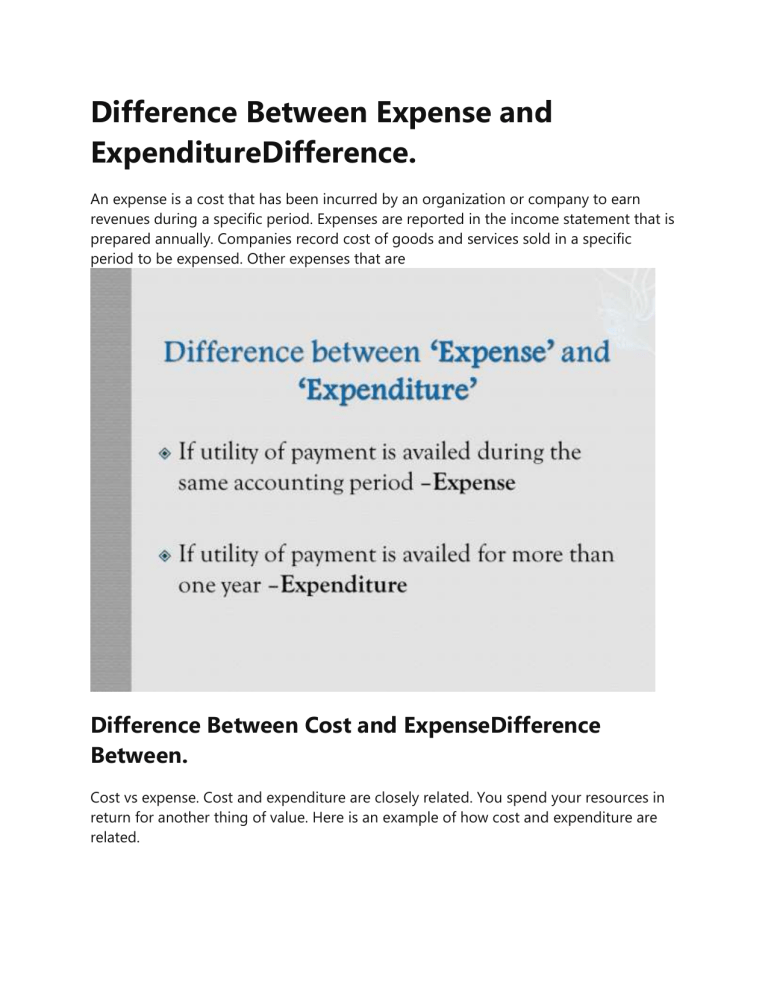

Difference Between Expense And Expenditure Difference Between

What Is Revenue Expenditure The Financial Express

How Income Statement Structure Content Reveal Earning Performance

Revenue Recognition Boundless Accounting

Difference Between Capital Expenditure And Revenue Expenditure Difference Between

Difference Between Capital Expenditure And Revenue Expenditure Difference Between

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-02-0538cfc8437b4b2ba4724c9443c6d393.jpg)

How Do Capital And Revenue Expenditures Differ

What Is An Expenditure Overview Guide And Examples

Capital And Revenue Expenditure Income Icse Class 10 Notes

Capital Expenditure And Revenue Expenditure Basic Concepts Of Financial Accounting For Cpa Exam

Difference Between Expense And Expenditure Difference

Comments

Post a Comment